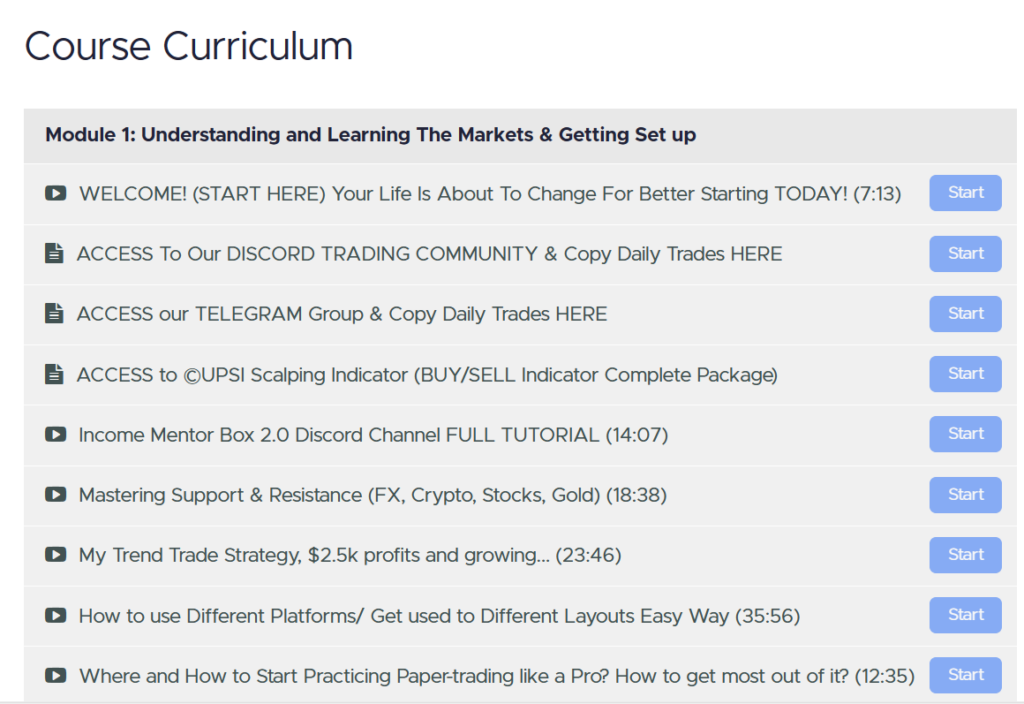

Venturing into the Forex trading world can be both exhilarating and daunting for beginners. With the market’s complexity and the high stakes involved, having a solid foundation and reliable guidance is crucial. This is where the Income Mentor Box Day Trading Academy shines as a beacon for novices.

Offering comprehensive lessons that cover everything from the basics of Forex trading to advanced strategies, Income Mentor Box is dedicated to turning beginners into proficient traders. If you’re looking to embark on your Forex trading journey with confidence, look no further. Join the Income Mentor Box Day Trading Academy today and start mastering the art of trading.

Educate Yourself on Forex

Diving into the forex market without a solid understanding of its workings is like navigating a ship in stormy seas without a compass. The forex market is vast, with daily transactions running into trillions of dollars.

Participants range from national banks and financial institutions to individual retail traders. Each has different strategies and levels of influence on currency movements. Key factors affecting currency values include interest rates, economic indicators, political events, and market sentiment.

To trade effectively, one must understand these elements and how they interrelate. This foundational knowledge can be built through a combination of reading authoritative texts, attending workshops or courses, and following market analyses. Being well-educated in forex trading equips you with the tools to make informed decisions, anticipate market movements, and manage risks more effectively.

Start with a Demo Account

A demo account is an invaluable tool for beginners in forex trading. It simulates the real forex market without the risk of losing real money, providing a practical platform for novices to gain experience.

Through a demo account, you can familiarize yourself with trading platforms, learn how to execute trades, test different trading strategies, and get a feel for the market dynamics.

This hands-on experience is crucial for building confidence and understanding market fluctuations. Furthermore, it allows you to make mistakes and learn from them in a risk-free environment. The insights gained from trading with a demo account lay a solid foundation for transitioning to live trading with real funds.

Develop a Trading Plan Forex

A well-thought-out trading plan is your roadmap to forex trading. It should outline your financial goals, risk tolerance, chosen currency pairs, trading strategies, and criteria for entering and exiting trades.

This plan acts as a guideline to keep your trading disciplined and focused, helping to avoid impulsive decisions driven by emotions. A trading plan should also include how you’ll manage your investment capital, specifying the maximum percentage of your capital you are willing to risk on any single trade.

Regularly reviewing and adjusting your plan based on your trading performance and changing market conditions is also essential. Adherence to a structured trading plan helps in maintaining consistency, managing risks, and ultimately achieving long-term profitability.

Use Leverage Wisely

Leverage in forex trading is a double-edged sword. It allows traders to open larger positions with a relatively small amount of invested capital, potentially leading to higher profits. However, the flip side is that it can also magnify losses.

For example, a 100:1 leverage means you can control a $100,000 position with just $1,000. While this can amplify gains, it can equally result in significant losses if the market moves against you.

Beginners should use leverage cautiously, starting with lower leverage ratios to understand how it affects their trades. Managing leverage effectively requires a good understanding of the market, a solid trading plan, and strict risk management practices.

Keep an Eye on News and Economic Indicators

The forex market is exceptionally sensitive to news and economic indicators. Reports on employment rates, inflation, GDP growth, and political events can cause significant market movements.

Traders should stay informed about these developments because they can offer trading opportunities or signals to exit a position.

Economic calendars are useful tools for tracking upcoming events and indicators. Analyzing the potential impact of such news can help traders anticipate market movements and adjust their strategies accordingly. However, it’s important to approach news trading with caution, as markets can be volatile and unpredictable around these events.

Practice Risk Management

Effective risk management is critical in forex trading. One fundamental tool is the stop-loss order, which automatically closes a trade at a predetermined level of loss. This can help limit potential losses to an acceptable level.

Determining your risk tolerance – the amount of money you’re willing to risk on a trade – is a personal decision and should be based on your financial situation and trading goals.

A common guideline is to risk no more than 1-2% of your trading capital on a single trade. This strategy helps preserve your capital over the long term, enabling you to trade another day, even after a series of losses.

Analyze the Forex Markets

Successful forex trading relies on the ability to predict future currency movements, which requires a combination of technical and fundamental analysis. Technical analysis involves studying price charts and using indicators to identify patterns that can suggest future movements.

Fundamental analysis, on the other hand, looks at economic indicators, interest rates, and political factors that can affect a currency’s value. A well-rounded trader will use both types of analysis to inform their trading decisions.

By understanding and applying these analytical methods, traders can better predict market movements and identify high-probability trading opportunities.

Stay Patient and Disciplined

Many newcomers to forex trading are drawn by the prospect of quick profits but achieving consistent success takes time, patience, and discipline. The market will not always move in your favor, and there will be losing trades.

The key is to remain disciplined in following your trading plan, keeping emotions in check, and not deviating from your strategies in search of instant gains.

Patience is required to wait for the right trading opportunities that match your criteria. Over time, a disciplined approach can lead to a better understanding of the market, more successful trades, and steady growth in your trading account.

Understand Currency Pairs

The forex market involves trading currency pairs, where you buy one currency and sell another. Beginners should start by focusing on a single currency pair, ideally one that is less volatile and more familiar.

Major currency pairs like EUR/USD or USD/JPY are often recommended for beginners due to their liquidity and lower spreads.

Understanding how a currency pair behaves requires studying its historical movements, the economies of the respective countries, and how they are affected by global economic events. Focusing on one pair allows traders to gain deep insights and expertise, increasing the chances of successful trades.

Keep Emotions in Check

Emotional control is vital in forex trading. Fear, greed, and excitement can lead to impulsive decisions, such as chasing losses or risking too much on a single trade.

Developing a trading plan and sticking to it helps mitigate emotional responses by providing clear guidelines for when to enter and exit trades.

It’s also important to set realistic expectations and not to expect to win every trade. Accepting losses as part of the trading process and learning from them without becoming emotionally attached can improve decision-making and lead to more consistent trading performance.

Final Thoughts on Forex Trading Tips for Beginners

In conclusion, mastering Forex trading as a beginner requires more than just understanding market trends; it demands comprehensive training and continuous learning. The Income Mentor Box Day Trading Academy stands as the premier platform for those aspiring to not only learn Forex trading but excel at it.

With its detailed courses and expert guidance, Income Mentor Box has proven to be an invaluable resource for traders at all levels. If you’re serious about building a successful trading career, it’s time to take action. Join the Income Mentor Box Day Trading Academy and embark on your journey to trading mastery today.

CLICK BELOW TO JOIN IMB 2.0