Pullback Trading Basics to Know

If you are just getting into the world of trading, whether stocks, Forex, or anything in between, a term you might have come across is pullback or pullback trading. This is quite a popular method of trading, one that can be quite profitable if executed profitably. However, of course, executing this type of trading properly is easier said than done.

In case you don’t know, a pullback occurs when a market is trending, and then quickly moves in the other direction, against the main trend. A pullback is a short term price move in the opposite direction of the general trend. Therefore, it is possible to make money on pullbacks, right in between when it occurs and where the trend will resume.

That is a very basic definition of what a pullback is, but it is very important for you to know nonetheless. With that being said, finding the right place to enter and exit a position for a profitable pullback is easier said than done. Today, we want to go over 5 pullback trading basics, 5 things you need to do before and after you open a position.

The 5 Pullback Trading Basics

Alright, so there are a few tips that you need to be familiar with in order to be profitable in pullback trading. The first 4 tricks are all about how to find and enter the right trades, and the 5th tip is related to exiting a trade and banking your profits. Let’s take a closer look.

Trade in the Trend’s Direction

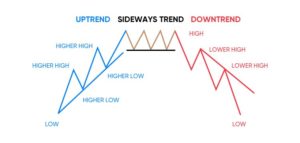

The first thing that you need to do in order for pullback trading to work is to find and identify a trend. For the purposes of today’s guide, we will be talking about uptrends. The point here is that a market has to be trending in order for pullback trading to work.

This is because pullbacks are fast movements that happen within a trend, and therefore, if there is no trend, then there also cannot be a pullback. Moreover, the trend needs to be visible on a chart on the same timeframe as you are trading on. The trend needs to match your timeframe.

Knowing the Type of Trend

Yes, knowing that there is a trend is of course very important for pullback trading. However, not all trends are the same. There are different levels or strengths of trends, and related, there are also different levels of pullbacks.

A strong trend is when the price respects the 20 moving average and remains above it, a healthy trend is when the price respects the 50 moving average and remains above it, and a weak trend is when the price respects the 200 moving average and remains above it. Related to this, strong trends tend to have relatively small or shallow pullbacks, whereas weak trends tend to have deeper or stronger pullbacks.

Identifying the type or strength of trend is very important for pullback trading, and it is so you can identify the areas of value on your charts. Defining the area of value will help you find the right spot to enter a trade, something we are about to discuss below.

Spotting the Area of Value

Before you can execute a pullback trade, you first need to identify the area of value to trade in. For example, in a downtrend the area of value is the area on a chart where selling pressure could push the price lower, and in an uptrend, the area of value is the area on a chart where buying pressure could push the price higher.

Keep in mind that the area of value is just that, an area on a chart, not a specific price. For example, in a weak uptrend, the area of value could be at the 200 moving average line. In a strong uptrend, the area of value will usually be at the 20 moving average line. In a healthy uptrend the area of value could be at the 50 MA.

Finding the Entry Trigger

Alright, so now there are three conditions that have been met. You have identified a trend, you have identified the type of trend, and you have identified the area of value. Now it is time for you to find the pattern or the entry trigger, or in other words, where and when to enter a trade.

As an example, if there is a strong trend, it means that the pullbacks will be relatively shallow, and therefore buying could be hard. In this case, the pullbacks can be very short-lived, with the trend resuming soon afterwards. The best way to go about this is to place a buy on the swing high.

However, when it comes to a weak trend, the pullbacks are usually much stronger or deeper. In this case in terms of an entry trigger, something like a bullish candlestick reversal pattern would work well.

Finding the Exit in Pullback Trading

Of course, one of the most important parts of pullback trading, to make a profit, is to find the right place to exit or close a trade. You can exit a trade both when you are right or wrong about the direction of the market.

For example, in a strong trend, a good way to close out your trades is to set the stop loss level at the 20 MA, so if the price dips below the 20 MA, the trade will close on its own. If the trend is a healthy one, exiting a trade by capturing the swing is a good way to go. You could also ride the trend on the 50 MA.

If the trend is weak, pullbacks are usually quite deep, and because of this, exiting the trade by capturing the swing at the previous swing high or at an area of resistance is recommended.

The Basics of Pullback Trading

If you follow the 5 pullback trading basics that we just went over, you shouldn’t have many issues making a profit!