Technical Indicators in Forex

When it comes to Forex trading, technical analysis and technical indicators are widely used to identify various market factors. This type of analysis is used to determine various aspects such as price volatility, trading volume, trends, and momentum too.

If you plan on engaging in technical analysis, whether you are trading stocks, commodities, Forex, or anything in between, you need to be familiar with technical indicators.

Today we want to provide you with a refresher on what technical analysis is, and moreover, what technical indicator are. Here you will find out what the types of technical indicators are, as well as some examples of the most prevalent ones out there.

Technical Analysis & Technical Indicators – The Basics

Before we dive into all of the different types and specific technical indicators out there, let’s first go through a small crash course in terms of what technical analysis is. Technical analysis is a special type of analysis used to forecast price direction, as well as other factors too.

Prior market data, mostly prices, momentum, and trading volume are all factors used to predict the future movement of prices. Through the use of technical analysis, a trader can predict future trends, price movements, trend reversals, and more.

The reason why this is so important to note is because the main way in which this type of analysis functions is through the use of the technical indicator. It’s the main tool used in this analysis methodology, and you need to become very familiar with it.

To give you a rudimentary definition, technical indicators are heuristic or pattern based signals. These signals are produced by the volume, price, and open interest of a security, contract, currency pair, stock, or any other such asset that can be traded.

Using these indicators, traders can analyze a myriad of historical data, things like volume, momentum, price, and more, to predict the future movement of prices.

When it comes to traders devoted to technical analysis, they also use technical indicators to find the right trading setups, the right entry points and exit points, and more. Technical indicators can also be used for setting ideal stop loss and take profit levels. It’s super important for risk management.

The 4 Types of Technical Indicators

What you may not know is that there is more than one type of technical indicator out there. In fact, there are 4 different types that you need to become intimately familiar with. The 4 main types of technical indicators are volatility, volume, momentum, and trend indicators. Right now, we want to take a much closer look at each of the 4.

Trend Indicators

The first type of technical indicator that you need to be familiar with is the trend indicator. This is a type of indicator which informs traders if the market is trending, or in other words, in which direction the market is moving in.

It may also be the case that the market is not moving in any particular direction. Technical trend indicators may also be called oscillators. This is because they generally move between high and low values, and thus they oscillate much like the waves of the ocean, going up and down, generally forming patterns.

As an example, one of the most widely used technical indicators to identify trends is the moving average. The moving average indicator is often simply referred to as MA.

This particular indicator uses various price points over a given period of time, which is then divided by the number of price points used. The result is a single trend line. Keep in mind that it can be used with varying timeframes.

Momentum Indicators

The next of the technical indicators that you need to be familiar with are momentum indicators. This is a type of indicator which is also related to trends, but instead of telling you in which direction a trend is moving, momentum indicators tell you how strong a particular trend is.

This type of indicator may also tell you if a trend is set to turn around or reverse. One of the main uses of this indicator is to find price tops and bottoms.

There are various momentum indicators out there, with the moving average convergence divergence indicator, also simply known as MACD, being one of the most widely used ones.

MACD consists of two parts, two moving averages which are effectively converted into an oscillator by taking the longer average out of the shorter one. MACD indicates momentum by oscillating between convergence, overlapping, and divergence.

Volume Indicators

The third of the technical indicators that you need to be familiar with is the volume indicator. Volume indicators can inform you of the volume of trade in a specific market. It can tell you how the volume of trade has changed over a given time period.

Simply put, it informs you of how many units are being bought and sold in accordance with a specific time period. This is super important, because when a price changes, the volume may indicate how strong a movement is.

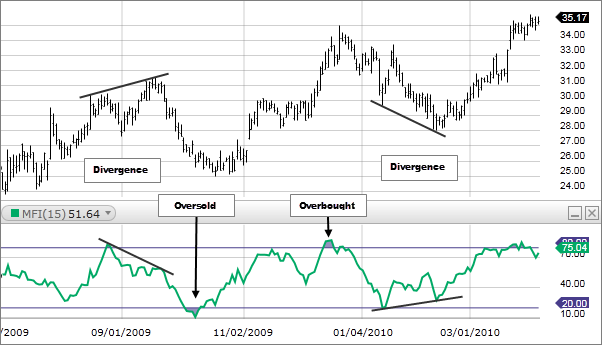

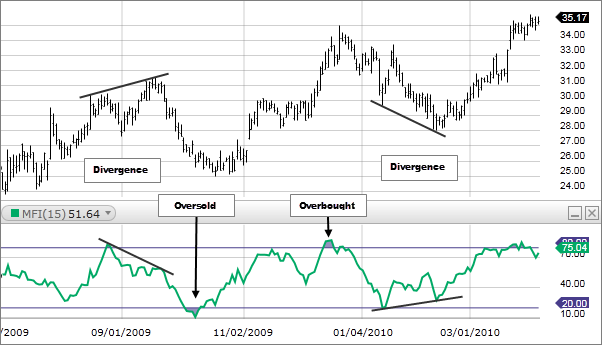

One of the most popular types of volume indicators out there is the MFI or money flow indicator. The money flow index indicator is one of the simplest volume indicators out there.

Volatility Indicators

The last of the technical indicators that you need to know about are the volatility indicators. These are used to inform traders of how much a price has changed over a certain amount of time. The fact of the matter is that if there is no volatility in a market, then there is no way to make a profit.

Simply put, prices have to change in order for traders to profit. The higher the volatility is, the faster and more prices are changing, and thus, the better the opportunity to make a profit.

One of the most commonly used volatility indicator is the Bollinger Bands indicator. This consists of two bands, which are 20 standard deviations below and above the 20 day moving average. When the lines diverge, volatility is high, and when the lines converge, volatility is low.

/BollingerBands-5c535dc646e0fb00013a1b8b.png)

Forex Technical Indicators – Final Thoughts

The bottom line is that if you plan to be a proficient technical analyst, whether in Forex or the stock market, or anything in between, being familiar with technical indicators is very important.