An Intro to Technical Analysis

In Forex trading, many traders use what is known as technical analysis to find entry and exit points for trades. This term, technical analysis, is one that you have probably heard before, but might not know what it means. Well, today we are here to provide you with a basic introduction to technical analysis in Forex trading.

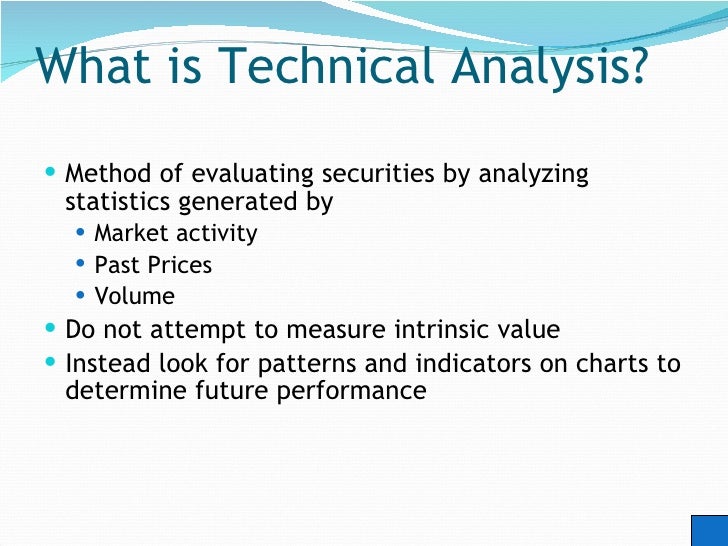

What is Technical Analysis?

Technical analysis is a methodology employed by traders to evaluate investments and positions, and to identify a variety of trading opportunities by analyzing statistics and trends. There are various factors analyzed including price movement, volume, and more.

This sort of analysis is all about focusing on and studying trading volume and price, particularly price movements. There are various technical analysis tools used to evaluate the ways in which supply and demand will affect price, volume, and volatility.

This type of analysis is often used to generate signals for short term trades, and charting tools are used virtually always to accomplish this. TA can be used to evaluate the historical data and make judgement calls on future prices for stocks, futures, commodities, fixed-income, currencies, and other securities.

Technical Analysis Basics

Technical analysis as we know it was first introduced to the world by Charles Dow in the 1800s. This type of analysis has evolved over the past 100+ years to include hundreds of signals, patterns, which have been developed through years of research.

The main assumption of this sort of analysis in trading is that the past changes in price and trading activity of a security are good indicators of the future movements of prices. However, technical analysis does need to be paired with some strict trading rules and other forms of research.

Some traders may limit themselves to limited types of analysis, but the best traders usually imply a myriad of analysis techniques, and this can include both technical and fundamental analysis.

There are two basic tenets which form the basis of technically analyzing markets. The first tenet is that markets are efficient with values representing factors that influence a security’s price. The second tenet is that even random market price movements appear to move in identifiable patterns with trends that often repeat over time.

3 Assumptions of Technical Analysis

There are actually 3 main assumptions included in the world of technical analysis, and you need to know about all of them.

Market Discounting

One main belief here is that everything including broad market factors, market psychology, and a company’s fundamentals are already priced into a stock. Technical analysists view price movements as the result of supply and demand, which an apply to stocks, commodities, currencies, and more.

Prices Move in Trends

Another leading assumption that technical analysts make is that prices move in trends. Even in markets where prices appear to move randomly, if one looks close enough, it is possible to find trends. The prices of currencies and stocks are more likely to continue with past trends than they are to move randomly.

History Repeats Itself

Another leading assumption here is that history usually always repeats itself. There is a repetitive nature in price movements, and this is generally based on trading psychology, and trading psychology tends to be quite predictable. TA involves the use of patterns and charts to analyze emotions and resulting market movements, with the end goal being to identify and understand trends.

How Technical Analysis is Used by Traders

Something you might be wondering is how this form of TA is used by traders. Well, traders attempt to forecast the direction and movement of a price through the use of various indicators, charting solutions, and the resulting patterns which those indicators create.

There are many types of indicators out there, with the 4 main ones being those that identify trends, those which analyze momentum, those which analyze trading volume, and those which analyze market volatility. Price trends, chart patterns, volume indicators, momentum indicators, oscillators, moving averages, support and resistance levels, and more are all used to achieve this goal.

The Benefits of TA

There are various benefits that can be attributed to the use of technical analysis, particularly in Forex trading, so let’s take a quick look at these.

Trend Analysis

One of the biggest benefits of technical analysis is its ability to identify trends in the market. Markets can move up, down, and sideway, and this type of analysis can identify these directional price movements.

Finding Entries & Exits

Another main advantage of technical analysis is that traders can time their trades just right and can find the best entry and exit points. Of course, the whole point of trading, whether Forex or otherwise, is to find the best spots to enter and exit a trade in order to make a profit.

Providing Early Signals

The next big benefit that you get here is that it can provide you with early signals and it can paint a picture of what the current psychology in a given market is like. This sort of analysis can also provide traders with an early warning when a trend reversal is on the horizon.

Quick & Cheap

Something else which many people like about technical analysis is that it is easy, quick, and cheap. There are tons of free charting solutions out there that come complete with all of the indicators you will ever need to make informed trading decisions. It’s all about getting quick and reliable info.

It Provides Lots of Info

This sort of analysis also has the ability to provide traders with a plethora of information. Factors such as support, resistance, chart pattern, momentum of the market, volatility, and trader’s psychology, and more can all be gleamed.

The Basics of Technical Analysis – Final Thoughts

There you have it folks, the basics of technical analysis. We hope that we have managed to provide you with a good idea of what this sort of analysis is all about. Stick around, because in the coming weeks, we will be diving deeper into this topic, specifically in terms of technical indicators that you might use to achieve everything that was discussed today.