Stock Market Trading Tips For Beginners

If you are looking to get into stock market trading, there are some important tips and pieces of advice that you should be familiar with. Today we want to cover some important tips and more. Andrew, the leader of our illustrious Income Mentor Box Day Trading Academy, has a few recent videos about this. We want to provide you with some essential stock market trading tips for beginners, so you know what you are getting into. Also, both videos which we have included today are prime examples of stock trading.

Stock Market Trading – Setting Long Term Goals

Something that traders entering the stock market need to do is to set long term goals. Here, you want to determine roughly when you would like to be able to see returns and what those returns should look like. Do you want to withdraw cash and sell stocks in 6 months, a year, 10 years, or when you retire?

Knowing what your long term profit goals are is extremely important when it comes to stock market trading. Some stocks and companies have relatively safe and stable growth but with smaller returns, some companies have stocks booming right now, and some are predicted to rise or decrease in the future.

What your long term goals are will work towards determining what markets you invest in, how much you invest, and how much risk you are looking to engage in. For stock market trading, just remember that it is not unlike gambling, because you really don’t know with total certainty whether or not there will be profits 5 or 10 years down the line, or really if that stock will even be worth anything in the future.

On that same note, something you definitely do not want to focus on in the stock market are short term goals. Stocks usually don’t soar in value from one week to the next. If you are stock market trading and you expect immediate results, big results right away, you might be in the wrong place. If you are looking to make fast money through day trading, it might be best for you to try the Forex market.

Keeping Emotions in Check in Stock Market Trading

One huge mistake which many people make, newbies especially, is to engage in emotional stock market trading. Folks, there is probably nothing worse that you could do than to trade using your heart. Trading using your emotions will inevitably land you in hot water.

Buying a stock because the price rose for 1 day and it looks attractive, or dumping a stock because you are fearful of further losses due to a couple days of a downward trend, you won’t get very far. Simply put, trading based on the bears and the bulls, insecurities, emotions, and split second rash decisions will get you nowhere.

Whatever the case, if you want to buy or sell a stock, you better have good reason for doing so. As you will learn from Andrew A, technical and fundamental analysis is key here. You actually need to do comprehensive research and analysis before stock market trading with any stock or security.

Diversify Your Stock Market Trading Portfolio

One of the biggest stock market trading tips that any pro worth his money will give you is to diversify your stock portfolio. In layman’s terms, this means investing in a diverse array of stocks and securities, not just one or two. Sure, Tesla might look like a great stock right now, but it might not always be. Who knows, things happen.

The point is that you should never put all of your eggs in one basket, because if that basket drops, you go hungry. Invest smaller amounts in an array of stocks across different sectors. For instance, diversifying your portfolio doesn’t mean buying stocks in 10 different oil companies instead of just one. If the oil market collapses, then you are in trouble.

Instead, you may want to invest in the energy sector, the automotive sector, the weapons industry, various commodities, and government bonds too. The point here is that a diverse stock market trading portfolio helps to decrease risk and spread it out. With a diverse portfolio, if a couple of stocks go south, at least you have something to fall back on to keep you afloat.

Your Risk Tolerance in Stock Market Trading

Something else you should be aware of when it comes to the stock market is what your own risk tolerance is. In other words, how much money are you willing to put on the line to achieve a certain goal. A big part of this is to see what your trading budget is like. How much capital for stock market trading do you have at your disposal?

Are you willing to risk $100 to make $1,000? Will you risk $1,000 to make $1,000? Will you risk $1,000 to make $100? These are all important questions you need to ask yourself. Moreover, how much money can you afford to lose? Simply put, don’t start eating through your grocery and rent money just to buy some stocks. Only invest with money that you can afford to lose.

Educate Yourself for Stock Market Trading

One of the worst things that you can do as a newbie is to start stock market trading without actually knowing anything about it. No, emotions have no place in day trading, but brains are a different story. You will only end up losing money if you start trading without an education.

There are several stock market principles, terms, and functions you need to know about before you start trading stocks.

- Financial Metrics

- Financial Definitions

- Stock Trading Strategies

- Popular Trading Methods

- Stock Market Order Types

- The Different Investment Accounts

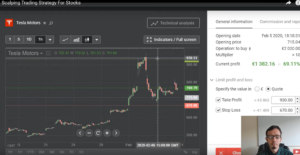

CLICK ON IMAGE TO GO TO ANDREW’S TRADING CHANNEL

Stock Market Trading Tips – Final Thoughts

Stock market trading is not easy, but it is certainly possible to make a profit if you do it right. Follow our tips, watch our videos, and join the Income Mentor Box Day Trading Academy to become the best day trader you can be.

CLICK BELOW TO JOIN INCOME MENTOR BOX AND START MAKING REAL PROFITS!