9 Biggest Trading Mistakes To Avoid

OFFICIAL SITE: INCOMEMENTORBOX.COM

There are lots of huge trading mistakes which newbies make, ones that will cost you a ton of money. Let’s get right to it and talk about the 9 biggest day trading mistakes you need to avoid if you expect to be successful in this venture.

The Biggest Trading Mistakes

Here we have a list of the 9 biggest day trading mistakes which all too many people make. If you expect to be profitable, whether day trading in Forex or investing in the market in general, these are the trading mistakes you need to stay away from at all costs.

Trading Mistakes 101: Avoid Going All In

One of the biggest and worst trading mistakes which newbies make is to go all in. Folks, trading is not unlike gambling, and in gambling, if you go all in, the odds are astronomically against you. Sure, there is an off chance that you will strike it big, but the odds are about the same as hitting the trifecta at the horse track.

Many traders may win a host of trades in a row, and it leads to a feeling of invincibility, that loss is not possible. These traders will then put all their eggs in a single basket, and risk it all in a big trade. People, this is a great way to blow all of your investment or trading capital in a single go. Simply put, you don’t want to risk more than 3% of your total holdings per trade. Much more than that is just way too risky.

Trading Mistakes Basics: Don’t Keep Trading After Significant Losses

Another massive trading mistake which many newbies will make is to keep trading even after significant losses. Now, it’s not like we are saying that if you have a bad, or even a bad week, and suffer large losses, that you should never trade again. However, that said, if you keep losing trades, and you are hemorrhaging money, it might be time to re-evaluate your skills and knowledge.

In other words, it might be time to take some sort of trading course, to take a few lessons, and just to re-assess the way you are trading. If trades are consistently being lost, don’t just keep trading the same way you have been. If you expect things to change, and you actually want to start winning trades, you will have to change things up if you expect the result to get better the next time around.

Risking More Than You Can Afford To Lose

Folks, even if you know what you are doing, and you have used all of the possible tools at your disposal, one of the biggest trading mistakes you can make is to risk more money than you can afford to lose. Sure, there are always long odds, trades that are riskier than others, ones with a big reward if you get it right.

However, the chance of losing a trade is always there, and if you do lose, if you have traded with more money than you can afford to lose, you have just dug yourself a massive hole that is going to be hard to get out of. This is not unlike using your credit card to buy a new television set for $6,000, when you know that you only have $3,000 of spending money for the next couple months. You never trade with more money than you can afford to lose, and that’s the bottom line.

Investing in Just A Single Asset or Asset Type

Yet another monumental trading mistake which so many beginners make is to trade in a single asset or asset type. In other words, not diversifying your trading and investment portfolio can be a massive mistake. Sure, maybe to Apple or Gold, or trading a certain currency through Forex looks like a great idea, and this may be so.

However, single stocks, securities, commodities, currencies, cryptocurrencies, or whatever else, even though they may show signs of increasing in value for a long period of time, things can and do go wrong. It’s called a trend, and trends change. If you have all of your cash invested in something like gold, or corn, or whatever else, things can quickly turn around.

If you only have your cash invested in a single asset or asset type, when things go downhill for that one asset, you will be in serious trouble. Therefore, it’s always a good idea to diversify an investment portfolio, to invest in multiple things, so if one goes downhill, you still have other investments or trades to keep you afloat.

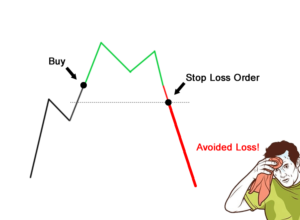

Trading Without A Stop Loss & Adding To Losing Trades

Another massive trading mistake which many make, especially newbies, is to not set a stop loss level. Folks, setting stop loss levels is so easy to do. You literally go to your broker or trading platform of choice, and before you execute a trade or investment, you set a stop loss level at a certain price or percentage point.

For example, if you invest $10,000 in a Forex trade, you can set the stop loss level to 50%. This means that if the value of your trade decreased by 50%, so down to $5,000, the trade will automatically close to stop you from losing your entire investment.

Related to this, another fatal trading mistake which all too many people make, is to add more money to a losing trade. Folks, if a trade is already losing, don’t add more money to it in the hopes that it will turn around and all of a sudden go the other way. The price can easily move against your position much longer than you anticipate, and this will spell certain doom for you.

A Big Trading Mistake: Choosing The Wrong Broker

Of the most fatal trading mistakes out there, choosing the wrong broker is perhaps one of the very biggest ones of all. Simply put, never invest money with a Forex or crypto broker if they do not have good reviews, if they have huge commissions, or are in financial trouble. Simply put, if a broker goes belly up, and you have a lot of money invested with them, well, tough cookies, you just lost it all. Take your time when choosing a broker, because it is going to make a massive difference.

ACCESS FREE CRYPTOCURRENCY MENTOR BOX SIGNALS BELOW!

Don’t Place Too Many Correlated Trades

Ok, so we did talk about portfolio diversification before, and how you want to invest in different things to minimize risk. Yes, this is still very true, but to clarify, what is meant by diversification is to not invest all money in a single asset, such as gold for instance. It is always a good idea to invest in a number of stocks, bonds, currencies, commodities, securities, and other asset types. However, when it comes to day trading, especially Forex, never place a ton of trades which appear to be correlated.

What is meant by correlation is that say if one Forex pair moves in a certain direction, correlated pairs will act in the same manner. Now, of course, if you get it right, and the market moves the way you anticipate, you can easily multiply your winnings. However, on the other hand, if you happen to make a bad call, or something unforeseen happens, all trades which are correlated are going to go south and cost you big time.

Attempting To Anticipate Market News & Only Trading Based On News

Yet another fatal day trading mistake which all too many people make is to try and anticipate news. Yes, there is the fact that important market news can and does affect price movements and values. However, this is only something you can accurately gauge once that specific piece of news has already been released.

All too many day traders will attempt to anticipate news releases, and what they are going to contain, before they ever happen. Sure, you might be intuitive, but you aren’t psychic, so attempting to accurately anticipate news releases is indeed very dangerous. You might anticipate the news wrong, and then place trades accordingly, trades which will then fail miserably once news is released, news that you did not anticipate properly.

On that same note, some day traders will only use news data to place trades. Folks, fundamental analysis is fine, and yes, it is useful, but you cannot rely on it solely. This means that you also need to perform real technical analysis, using charts and indicators, to accurately gauge the market and execute profitable trades. Relying too much on news can be a disastrous trading mistake indeed.

Trading Mistakes: Trading Without Knowledge, Training, & A Plan

The final trading mistake which all too many people make is to trade without knowing how to do so. Folks, it’s like driving a car if you have never been behind the wheel before, or baking if you don’t know what an oven is. Day trading and investing is not just something you can do on a whim. You can’t just wake up one day and decide that today you will start day trading profitably.

Trading and investing is a serious business, and it’s why many people hire brokers to trade and invest on their behalf, because it’s not easy. If you have never taken some lessons or slowly gained experience, don’t just jump into it. This is not the kind of thing you do by hitting the ground running. You can’t just jump right into the deep end and hope for the best. Learn how to trade, develop a plan, and stick to it.

9 Day Trading Mistakes – Final Thoughts

There you have it folks, the 9 biggest and most fatal trading mistakes that newbies make. If you want to learn how to be the best trader you can be, a course like the Income Mentor Box Day Trading Academy is definitely recommended!