Forex Price Action Scalping Strategy

OFFICIAL SITE: INCOMEMENTORBOX.COM

When it comes to Forex or foreign exchange trading, Forex price action scalping is something that you definitely need to be familiar with. Price action scalping is a great way to place a large quantity of small trades, with the aim of making lots of individual profits, small profits, but lots of them. As you will quickly find out, this Forex trading strategy has more to do with the sheer quantity of trades, rather than the size of individual trades.

Now, Forex price action scalping can be a bit difficult to understand, and especially to master, but that is what we are here for today. When it comes down to it, this can be an extremely lucrative and productive Forex trading strategy to put to use, but you do have to know what you are doing. Today we want to explain exactly what Forex price action scalping is, how it’s done, and how you can make money doing so.

Price Action Scalping – What is Scalping?

First off, before we get into Forex price action scalping, known what scalping in itself is would probably prove to be quite helpful, so let’s cover this first. Scalping is a very time friendly and quick way of foreign exchange trading.

It is characterized by exploiting price gaps cause by bid-ask spreads, as well as order flows. This is all about making the spread or buying at the bid price, and then selling at the ask price to generate profits via the difference between said two price points.

Now, scalping is all about holding positions for minimal amounts of time. As we mentioned before, scalping is all about taking advantage of small and frequent moves, or in other words, it’s about placing a large quantity of small trades. Yes, since profit margins are small, the aim here is to trade in extremely liquid markets, thus allowing for high frequency trading.

Price Action Scalping – What is Price Action?

If you are going to understand this strategy, you do need to know what price action is, so let’s explain this in a simple manner. Price action is a way of analyzing the Forex market without actually having to use indicators, which can be very useful.

Instead of using indicators, for price action analysis, you use candlesticks, support and resistance, and other forms of charting analysis. This is something which allows you to predict Forex price movements with a high degree of accuracy. It does this by allowing you to understand whether buyers or sellers are controlling the price.

Something important to keep in mind here is that if sellers are in control, you want to sell, and if buyers are in control, you want to buy. Being able to recognize who is in control of the price is what price action is all about, and it will go a long way in forming a complete Forex price action scalping strategy.

Forex Price Action Scalping – Basic Rules & Principles

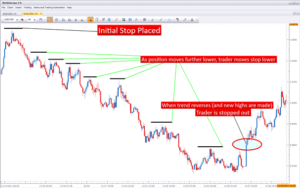

Now it’s time for us to cover the basics of Forex price action scalping, and what you need to do in order to start putting real profits in your pockets. A big part of this price action scalping strategy is the trading of trend continuation. In simplest terms, this involves watching for price action signals which indicate a strong trend, and then trading that continuation when the price pulls back to an area of support or resistance.

It all sounds very easy, but there are some key rules to remember. For one, you have to maintain a risk to reward ratio of 1:3 at the very least. Moreover, the key takeaway here is that you’ll only scalp trade from areas of either support or resistance, and that you’ll only enter trades when there are continuations. Finally, your target needs to be at least three times the size of the stop. To make this Forex price action scalping strategy clearer, let’s no talk about continuations, as well as support and resistance.

Price Action Scalping & Support and Resistance

You do have to be familiar with support and resistance to put this price action scalping strategy to use. What you need to know about support and resistance is that recent data is always the most important, and that body bounces are far more important than wick bounces.

So, you always want to be using fresh and new data, as opposed to old data, which is even more important when it comes to small timeframes. A good way to go here is to look at the previous 2 days on a 5 minute chart.

Bounces

Something in relation to support and resistance that you need to know how to handle are bounces, so let’s go over that right now. You need to be able to identify bounces on your chart, with the ideal being when several bounces line up. Bounces may not always be totally obvious, but when bounces are very obvious, that area is strong, so being able to identify the most prominent bounces is very important.

In order to put it all together, you have to draw a horizontal line between said bounces and join them together. You look for the strongest bounces and make lines. This is really easy to do on 5 minute charts, but can be much harder with larger time frames. Now, always keep in mind that body bounces are much more important than wick bounces, or in other words, lines are placed at bounces on candle bodies, not the candle wicks.

Price Action Scalping & Continuations

Now that you know how to identify and place support and resistance areas, the next thing you need to know for PAS is finding the right trading setups. Keep in mind that you do need to be familiar with Forex trading basics, especially candlestick charts, for this all to make sense.

The big point here is that you need to use price action to determine a trend, so you can find good entry and exit points, of course, with the end goal of making money.

Keep in mind that in a bearish trend, sellers are in control of the price, and in a bullish trend, buyers are in control of the price. The most important takeaway with these trend continuations is that you want to trade with the trend. If there is a trend that is alive and well, enter the trade for a quick few pips, then cut and run with your small profit. You’re going to have to know about spreads, pairs, stops, and targets to make this Forex price action scalping strategy come to life, so let’s do that next.

Forex Price Action Scalping – Stops, Targets, Pairs, & Spreads

First off, to make this all come together, you need to be familiar with stops and targets. For a basic example, a good target level is 15 pips with a stop level of 5 pips. You may go as high as a 30 pip target and a 10 pip stop. As you keep working with this price action scalping strategy, knowing what targets and stops to use will become easier.

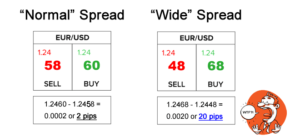

What you also need to know has to do with pairs. The pairs you trade with are going to be determined by their spread. You will want to set a stop loss of between 5 and 10 pips for the Forex price action scalping strategy, and therefore, to be profitable, you need foreign exchange pairs with very tight spreads. Some of the best pairs to trade with price action scalping include EUR/USD, GBP/USD, AUD/USD, GBP/AUD, USD/CAD, USD/JPY.

Putting The Forex Price Action Scalping Strategy To Use

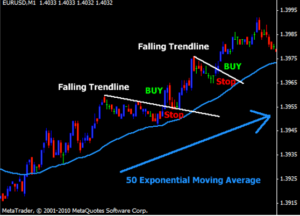

Ok, so just for an example, here we have what is known as the 15 Pip breakout Forex scalper, and it’s a great example of this Forex PAS strategy in use. Keep in mind that this very particular strategy works best when trading with EURO/USD and GBP/USD. The stop loss here is going to be around 9 pips, with the profit target of 15 pips or more. For this version of the price action scalping strategy, you’ll want to use a 1 minute chart, and you will also want to use a 50 EMA indicator.

Placing A Buy Trade With The Forex Price Action Scalping Strategy

The 50 EMA slopes up and the exchange price is trading above the 50 EMA. Now, draw falling trend lines in the up trend, and then buy EURO/USD and GBP/USD is the price breaks and closes above the falling trend line. Make sure to place your stop loss at 1 pip below the breakout candlestick. The stop loss should never exceed 15 pips. The take profit objective here is 15 pips or higher.

Placing A Sell Trade With The Forex Price Action Scalping Strategy

The 50 EMA slopes down and the exchange price is trading below the 50 EMA. Now, draw rising trend lines in the up trend, and then buy EURO/USD and GBP/USD is the price breaks and closes below the rising trend line. Make sure to place your stop loss at 1 pip below the breakout candlestick. The stop loss should never exceed 15 pips. The take profit objective here is 15 pips or higher.

Forex Price Action Scalping – Final Thoughts

Folks, as you can see, this Forex price action scalping strategy is not terrible easy to master, and yes, there are many facets you need to master. However, that being said, if you know what you are doing, you can put this Forex price action scalping method to good use to make a ton of small trades, each with significant profit.